DIF’s autumn theme growth was discussed on 19th September at the lunch event hosted by Alumni. Jaana Laine-Richter (CEO, Alumni Finland) opened the event, after which Magnus Tegborg (Founder and CEO, Alumni) facilitated the discussion on growth. The panelists were board members Yrjö Närhinen, Päivi Rekonen, and Anne Årneby.

Long-term commitment

Rekonen reminded us that board work is not a one-year exercise; you must commit for the long term. It starts by knowing you have something to say and you can help. You have to be interested in the industry and the company.

It takes some time, let’s say eight months, before you get into the work as a newcomer. You have to understand what the company is, the strategy, the core competencies and capabilities, how to differentiate, where the market is going, and where the disruption is coming from.

Disrupt – or get disrupted

How have companies X or Y disrupted the market? Your job is to learn and understand how to disrupt. If you are a market leader, you should not become arrogant and lose touch with what is happening in the market and with customers.

Scenarios are good for opening discussions

You need to be open-minded regarding scenarios; what are our plan Bs and Cs? Scenarios are good for opening discussions: how do we see the world, and do we see it similarly?

Dig into the strategic assumptions of each scenario.

![]()

![]()

![]()

![]()

![]()

Now on the board´s agenda: Regulatory environment and AI

Närhinen highlighted that the board must look at the current topics, such as ESG, data security, and AI, from the business perspective: what is business-relevant.

There are different approaches towards the regulatory environment of ESG, for example. Some feel overwhelmed; others embrace ESG (so we end up talking (only) about ESG). ESG should be aligned with the strategic framework of the company.

Make it easy for CEOs – Be clear with your (growth) agenda

If the agenda is clear, what we want the management to do, it is easier to deliver. If the growth agenda is unclear, it is at the level of ”let’s do sustainable, profitable growth”. Regarding this, listed companies could learn much from private equity firms or family businesses.

Often, unofficial discussions are an excellent way to clarify, e.g., if the biggest owners are in line or if there is a big difference in the approach to growth.

Storytelling is important. You need to see where the industry is going, set up the vision of where the company is going, and how to contribute, e.g., to ESG.

What story do you tell and wish to convey?

We need to educate ourselves further

Årneby stated that we need to educate ourselves. Board work has changed. It is nowadays very challenging and requires more time, energy, and knowledge. It is good to make a personal development plan to understand enough where and how to create an impact.

Opportunity is in value creation

Value creation comes from a clear owner agenda, which directs metrics. Knowledge sharing and closer relationships with management, not only with the CEO, are essential to see the opportunities, presented Årneby.

Årneby advised boards to visualize the value creation. That way, you can look at the value chain, where the disruption may happen, and maybe you can be the disrupter yourself before someone else.

How do we drive the value the best possble way?

A concrete example:

- 2-day workshop with management and board of directors

- Drawing simple value chains

- Discussing and getting different perspectives within the group

![]()

![]()

![]()

![]()

![]()

![]()

![]()

Panel discussion: What does it – the growth – take?

”Sounds good, but how do we double? What would it take?”

It is not about the CEO (presenting and telling what to do) but a dialogue and discussion. You have to make clear how to drive growth: is it M&A or partnering, for example, Rekonen clarified.

It is about choosing and making decisions

How much growth do we need? How much should be organic growth? What about inorganic growth: what is the cost of it? What are the financial metrics?

Growth means choosing. You have to articulate things clearly aloud. What doors are we opening – what doors need to be closed, Närhinen explained.

![]()

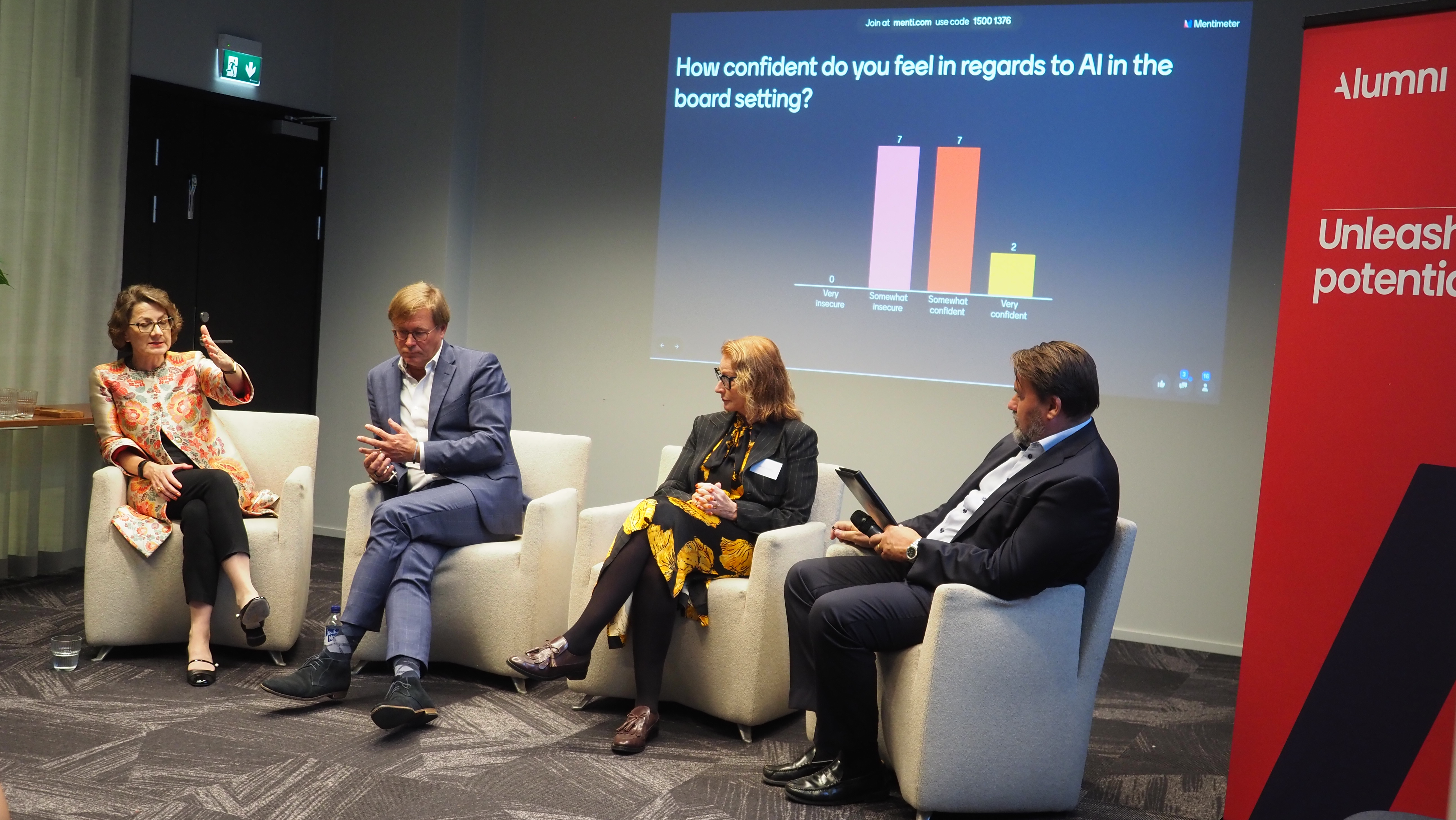

AI on the board´s agenda

Rekonen asked to think about the meaning of AI for a particular company. Where are we now, and what the role of AI could be in the future? Is it relevant – and relevant in the future? How should it be integrated into the organization: do we, for example, train everyone to a certain level to understand and use AI.

Årneby reminded us that we are now taking baby steps. We need to learn more (about AI and ESG) before implementing. We have to acknowledge that we are currently at that stage.

Närhinen pointed out that everyone understands AI differently – and typically, we do not explain how we understand it. However, it is like any other change in a business landscape, quite profound like the Internet, but still like anything else, any disruption.

Companies are more and more data-driven, and there are opportunities. To run a data-rich company, you need specific capabilities in the ’orchestra’. You can first start with the data strategy, control, risk, and automation. There are concrete steps you can take.

A simple customer journey model can be employed to inform people about the data´s source and its intended purpose.

We must clarify what AI is to us, our industry, and understand the risks and opportunities.

Honest discussion; it is about people

Honest discussion is needed about growth. Is this something we have energy on?

Are we up for the challenge – or is it something we choose not to take?

It is (also) about people, Rekonen pointed out.

Capital, competence, and risk ability determine choices. Make choices and understand the consequences in the long term.

The weather is what it is; we just need to navigate

Constantly challenge yourself and the team: how things work together and how to scale up.

Understand the value chain.

Navigate and be flexible!

![]()